What is a sort code and where can I find it?

A sort code is a six-digit number used to identify your bank and branch. You’ll often need it when setting up direct debits, receiving payments, or transferring money between accounts.

Where can I find my sort code?

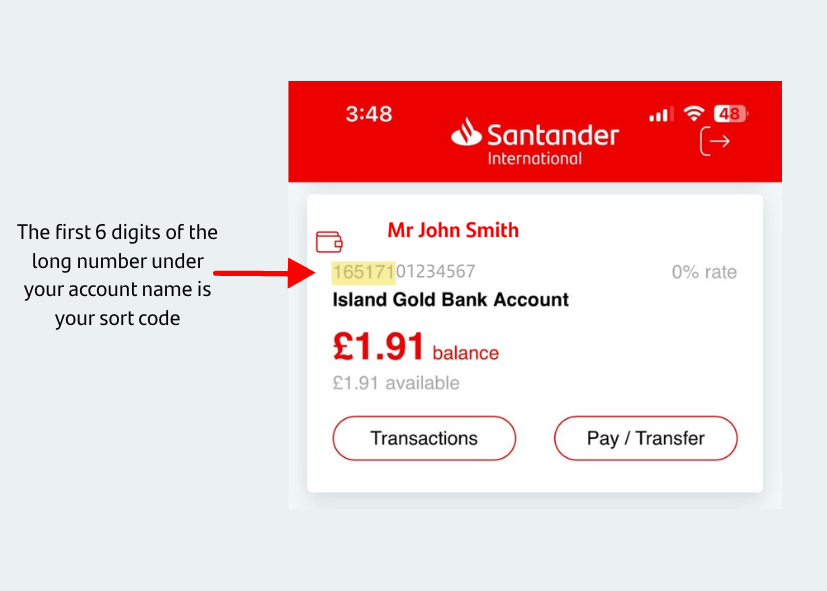

- In Online and Mobile Banking, your sort code is shown as part of a longer number directly beneath your account name. This number combines your sort code and account number—the sort code is the first six digits.

- On your bank statements – under the section titled “Account details”, look for the line that says “Your account number is”. The first six digits shown there are your sort code.

What is the bank’s BIC/SWIFT code?

A BIC (Bank Identifier Code), also known as a SWIFT code, is an international standard used to identify banks and financial institutions worldwide. You’ll need it when sending or receiving international payments.

Our BIC/SWIFT code is: ANILJESH

Where can I find my IBAN?

An IBAN (International Bank Account Number) is a unique code used internationally to identify your specific bank account. It’s required for sending or receiving payments from abroad, ensuring your money reaches the correct account.

You can find your IBAN in the following ways:

- On your bank statement – in the Account details section, look for the line that says “The International Bank Account Number (IBAN) for your account is”.

- By contacting us – if you can’t find your IBAN, our team will be happy to help.

Can I do my banking in the Work Café?

Yes, you can carry out your banking in our Work Café locations in Jersey and the Isle of Man. To ensure you receive the best service and avoid waiting, we recommend booking an appointment in advance.

Book a banking appointment in Jersey

Book a banking appointment in the Isle of Man

Walk-ins are welcome, but booking ahead helps us prepare for your visit and serve you more efficiently.

Why is my Visa debit card not working?

There are a few reasons why your Visa debit card might not be working:

- Activation: If your card is new, it may need to be activated before you can use it.

- Inactivity: If you haven’t used your card for a long time, it may have been cancelled for security reasons.

- Other issues: There could be other reasons, such as a block on your account or technical issues.

What should I do?

Please contact us so we can check your card status and help resolve the issue.

My Charge Card is not working what should I do?

Your Santander International Charge Card is issued and managed by AF Payments Limited, part of the Accomplish group, pursuant to a licence by Mastercard International.

If your Charge Card isn’t working, log in to your Santander International Charge Card app to:

- Report an issue

- Order a replacement card

- Report it as lost or stolen

If you still need help, you can contact Accomplish directly—full details are available in the app. To find them:

- Tap the three horizontal lines in the top left corner to open the menu

- Select Documents and Information

- Choose Contact Us

How do I update my address or contact details?

To update your address or contact details, you can:

- Complete a Change of Details form – Download the form here. Once completed, you can either post it to us or bring it into our Work Café in Jersey or the Isle of Man.

- Call us and we’ll help you update your information over the phone.

Please note:

- You’ll need to provide documentary evidence of your new address. Acceptable documents include a recent utility bill, local rates bill, or tax bill (these are just examples). For a full list of acceptable documents, please refer to our Documents you will need to provide leaflet.

- If you are changing your name, we will need to see documentary evidence such as the original or a certified copy of your marriage certificate or deed poll.

If you have any questions or need assistance, please contact us and we’ll be happy to help.

How do I make a payment from my corporate account?

You can make a payment from your corporate account in two ways:

- Online: Log in to your Online Banking and follow the instructions to make a payment.

- Written instruction: You can also send us a written payment instruction if you’re unable to use online banking.

If you need help or further guidance, please contact us and our team will be happy to assist.

How do I register for Online and Mobile Banking?

Registering is easy and only takes a few minutes.

To get started:

- Click on Online Banking and select Register at the top of the page.

- You’ll need:

- An active Santander International account

- To be registered for our Telephone Banking service

- Your Membership Number

- Your Activation Code

How to get your Membership Number and Activation Code:

Please call our Customer Service team. They will provide you with a Membership Number and send you an Activation Code by email. Once you have received these, you can start the online registration process.

For step-by-step instructions on registering for Mobile Banking, click here.

If you need any help, our team will be happy to guide you through the steps.

Am I covered under a Depositor Compensation Scheme?

Santander International is the trading name of Santander Financial Services plc, Santander Financial Services plc, Jersey Branch and Santander Financial Services plc, Isle of Man Branch.

The compensation scheme that applies to your account depends on where your account is held:

-

Jersey accounts:

Accounts with Santander Financial Services plc, Jersey Branch are covered by the Jersey Bank Depositors Compensation Scheme. -

Isle of Man accounts:

Accounts with Santander Financial Services plc, Isle of Man Branch are covered by the Isle of Man Depositors’ Compensation Scheme. -

UK accounts:

Accounts with Santander Financial Services plc in the UK are covered by the UK Financial Services Compensation Scheme (FSCS).

For full details and eligibility, please click here.

Can you help with my Santander UK account?

No, we are a separate entity from Santander UK.

For help with your Santander UK account, please contact Santander UK directly.